Volume and other indicators should be considered as factors to confirm the breakdown before entering the trade.Ĭharacterization: It is a price pattern that is denoted by the intersection of trend lines on a price chart. This pattern is very reliable like the ascending triangles. Trade can be initiated once the breakdown of the horizontal line is confirmed. The upper trendline meets the lower trendline through its diagonal inclination to form an apex. Here, the lower trendline is horizontal, joining the near-identical lows. It is considered a breakdown model and is bearish in nature. This pattern has a high success rate, and the target can be set equal to the depth of the triangle.ĭescending Triangle Pattern: It is basically the inverted version of the ascended triangle pattern. A long entry can be commenced when a candle closes above the horizontal line. A trade can be entered in this case when there is a clear breakout from the horizontal line. This forms a bullish pattern, and it can be generated in any market condition. Īscending Triangle Pattern: It is formed by two trendlines – a horizontal line that connects with the swing highs and a slanted line that connects with the higher lows. Placing a stop-loss order under the major swing low and below the major swing high for a brief setup can be a good plan. Good rewards are in store for those incorporating the study of these patterns for investing. As symmetrical triangles are inclined to continuation break patterns, it climbs or descends in the direction of the starting moves before the triangle is formed. Enter a trade when the breakout/breakdown is clear. The price makes its way towards the apex, it will inescapably violate the upper trendline for an escalation and signify the rising prices whereas there might be a case where the lower trendline might be breached forming a breakdown and continuing spiralling downwards with falling prices. Upper trendline and a diagonally ascending lower trendline. Symmetrical Triangle Pattern: This pattern style is constituted of a diagonally converging Types: The three noticed variations in the triangle patterns are. Technical analysts classify the triangle patterns as continuation patterns.

The pattern is often represented by drawing trendlines along an intersecting price scale, which suggests a stoppage in the ongoing trend.

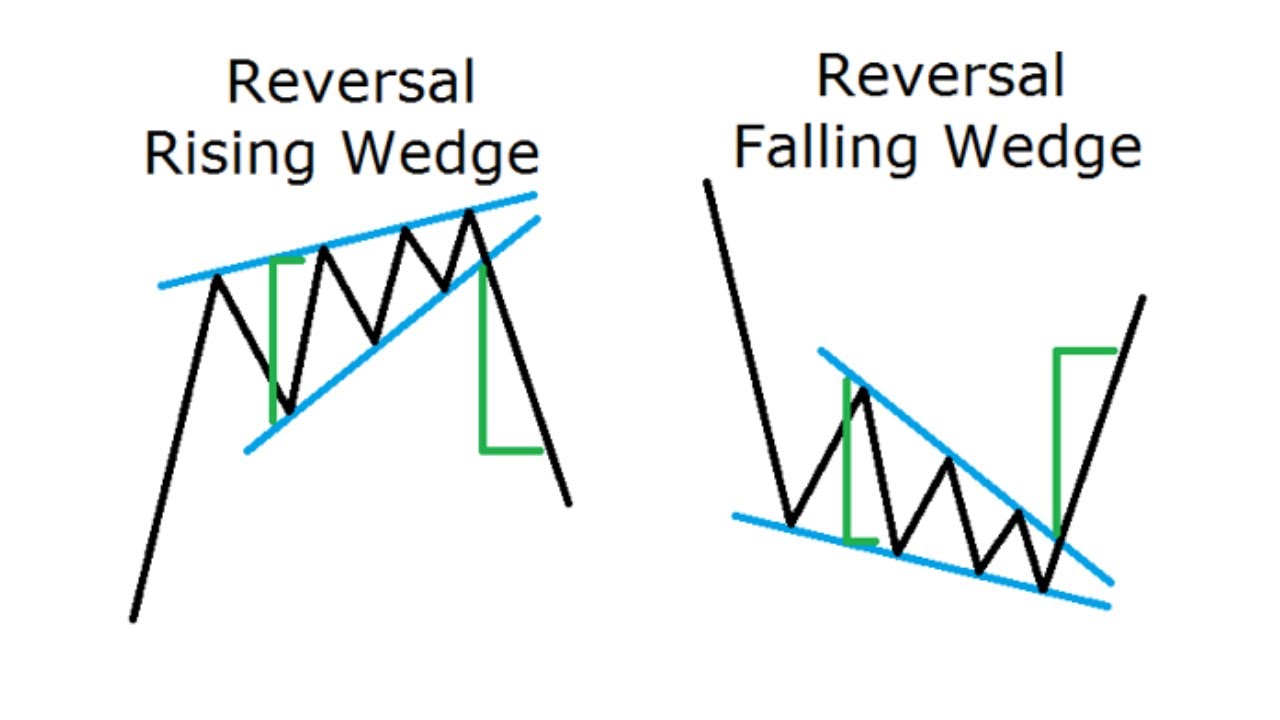

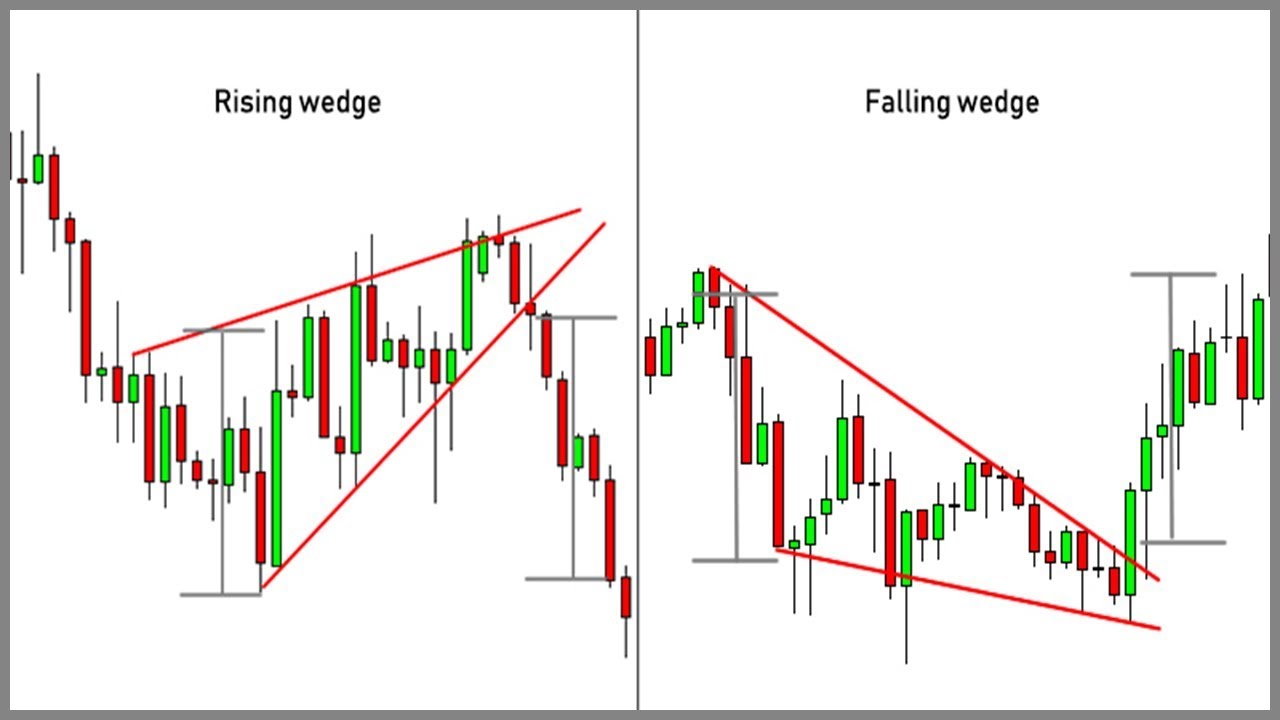

These charts are the underpinnings of a well-calculated move when it comes to the assessment of risk and reward ratios. Two of the most significant chart models in technical analysis are the wedge and triangle charts.Ĭharacterization: Triangle chart patterns are one of the most resourceful and practically advanced templates in technical analysis.

These charts reflect the past performance in a calculated manner. Chart patterns aid traders in efficiently and effectively analysing stocks. One of the paramount divisions in the department of technical analysis of the equity market is the analysis of charts. Technical analysis is used to gauge investments and recognize trading opportunities with statistical figures and shifts assembled from recent market developments. The most vital lesson in the commodities exchange classroom is the chapter on technical trading and analysis. To avoid the short end of the stick in the equity exchange ecosystem, being a devoted student is a must. As the stock exchange accommodates new investors every day, the stark gap between the seasoned players and the neophytes often starts to get exposed.

0 kommentar(er)

0 kommentar(er)